Elements of Book Keeping and Accountancy is an important vocational subject in the CBSE Class 10 curriculum for the academic session 2025–26. The subject introduces students to the fundamental principles of accounting, which are essential for understanding how business transactions are recorded, classified, and summarised in a systematic manner. It builds a strong foundation for students who wish to pursue commerce, finance, management, or entrepreneurship in higher classes.

The course focuses on basic accounting concepts such as business transactions, source documents, journal entries, ledger accounts, trial balance, and final accounts. Students also learn about cash books, banking transactions, and simple financial statements, which help them understand the financial position and performance of a business. Emphasis is laid on accuracy, discipline, and logical thinking while maintaining accounts.

Elements of Book Keeping and Accountancy not only develop numerical ability but also enhance analytical and decision-making skills. It enables students to understand the importance of financial records in day-to-day business operations and personal finance management. By studying this subject, learners gain practical knowledge that is useful in real-life situations, such as budgeting, saving, and understanding profits and losses. Overall, the subject serves as a stepping stone toward professional courses like Accountancy, Business Studies, and Chartered Accountancy in the future.

CBSE Class 10 Elements of Book Keeping and Accountancy Sample Paper 2025-26: Highlights

To help students prepare effectively for the upcoming board and half-yearly exams, the CBSE has released subject-wise sample papers along with their corresponding marking schemes. Below are the key details you need to know:

|

Feature |

Details |

|

Released by |

Central Board of Secondary Education (CBSE) |

|

For Academic Session |

2025-26 |

|

Applicable for |

CBSE Class 10 Half-Yearly, Pre-Board & Board Exams in 2025-26 |

|

Subjects Covered |

Elements of Bookkeeping and Accountancy |

|

Medium |

English and Hindi (for selected subjects) |

|

Includes |

Sample Question Paper + Detailed Marking Scheme |

|

Availability |

Downloadable in PDF format |

CBSE Class 10 Elements of Book Keeping and Accountancy Sample Paper 2026 Marking Scheme

The CBSE Class 10 Elements of Book-Keeping and Accountancy (Subject Code 254) syllabus for the 2026 academic year is published officially and available as a PDF download from the CBSE Academic website. This syllabus is meant for students appearing in the 2026 board examination.

The course aims to build basic accounting skills, including understanding principles, recording transactions, and preparing simple financial statements. The theory paper is 70 marks, supported by a 30-mark project, combining to make a 100-mark subject.

Main Units (Theory 70 marks):

-

Introduction to Bookkeeping and Accounting – fundamentals, objectives, and advantages of accounting.

-

Accounting Equation Effects – business entity concept and dual aspect.

-

Nature of Accounts & Rules of Debit and Credit – classification of accounts and voucher preparation.

-

Journal – recording entries and subsidiary books.

-

Ledger – posting and balances.

-

Recording & Posting of Cash Transactions – cash book usage.

-

Trial Balance – preparation and purpose.

Project Work (30 marks):

Practical application tasks related to real accounting scenarios, reinforcing classroom learning.

You can download the official syllabus PDF directly from the CBSE Academic site (look for the 2025-26 Elements of Book-Keeping and Accountancy document).

CBSE Class 10 Elements of Book Keeping and Accountancy Sample Paper 2026 with Solutions PDF Download

Download Free PDF of Class 10 Accounts Sample Paper 2026:

ElementsBookKeepingAccountancy-SQP

ElementsBookKeepingAccountancy-MS

CBSE Class 10 Elements of Book Keeping and Accountancy Sample Paper 2026

We are providing the sample paper below:

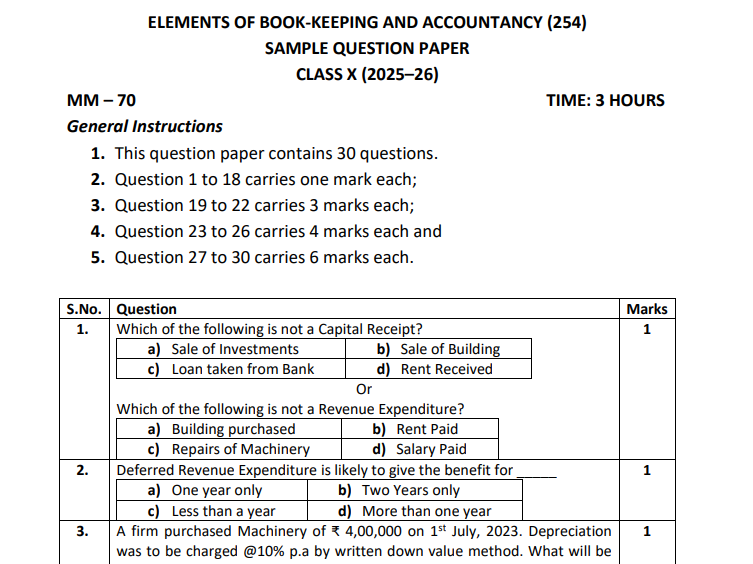

General Instructions

1. This question paper contains 30 questions.

2. Question 1 to 18 carries one mark each;

3. Question 19 to 22 carries 3 marks each;

4. Questions 23 to 26 carry 4 marks each and

5. Questions 27 to 30 carry 6 marks each.

1. Which of the following is not a Capital Receipt?

|

a) Sale of Investments |

b) Sale of Building |

|

c) Loan taken from the Bank |

d) Rent Received |

Or

Which of the following is not a Revenue Expenditure?

|

a) Building purchased |

b) Rent Paid |

|

c) Repairs of Machinery |

d) Salary Paid |

2. Deferred Revenue Expenditure is likely to give the benefit for

|

a) One year only |

b) Two Years only |

|

c) Less than a year |

d) More than one year |

3. A firm purchased Machinery of ₹ 4,00,000 on 1st July, 2023. Depreciation was to be charged @10% p.a by the written down value method. What will be the book value of Machinery on 31 March, 2025?

a) ₹ 3,33,000 b) ₹ 3,30,000 c) ₹ 3,24,000 d) ₹ 3,20,000

Or

A firm purchased a Building of ₹ 6,00,000 on 1st April, 2022. Depreciation was to be charged @10% p.a by the Straight Line method. What will be the total depreciation charged till March 31, 2025?

a) ₹ 60,000 b) ₹ 1,80,000 c) ₹ 1,20,000 d) ₹ 1,62,600

4. On 1st April, 2023, Mario Ltd. purchased equipment of ₹ 10,00,000. Depreciation was to be charged @ 10% p.a by a fixed instalment system. On the same day, Frontier Ltd also purchased equipment of the same amount and charged depreciation @ 10% p.a by reducing the instalment system. On 31 March 2025, which of the following statements holds true?

a) Total Depreciation charged to both firms will be the same for two years

b) Total Depreciation charged by Mario Ltd. will be more than Frontier Ltd. for two years

c) Total Depreciation charged by Mario Ltd. will be less than Frontier Ltd. for two years

d) Depreciation amount for the year ending March 31, 2025, will be the same for both firms.

5. Bank Reconciliation Statement is prepared ______ .

a) Every month

b) Every Quarter

c) Every Year

d) When the Cash book and passbook balance are not the same

Or

Bank Reconciliation statement is prepared by:

a) Bank b) Lender c) Government d) Account Holder

To get the rest of the questions, students can check the PDF link with direct access below for FREE:

CBSE Class 10 Elements of Book Keeping and Accountancy Sample Paper 2025-26 Answer Key

Students can check the important instructions and the answers below:

1. d) Rent Received or a) Building purchased

2. d) More than one year

3. a) ₹ 3,33,000 Or b) ₹ 1,80,000

4. b) Total Depreciation charged by Mario Ltd. will be more than Frontier Ltd. for two years

5. d) When the Cash Book and Pass Book balances are not the same, or d) Account Holder

To get the full answer key, students can check the PDF below from the link that they can access for FREE.

FAQs

1. What is Elements of Book Keeping and Accountancy in CBSE Class 10?

It is an elective subject under CBSE Class 10 that focuses on basic accounting principles and skills. Students learn how to record and maintain business transactions systematically.

2. What is the main objective of this subject?

The objective is to enable students to understand bookkeeping fundamentals and develop practical skills for preparing and maintaining books of accounts from given business details.

3. How many marks is the board exam and what is the duration?

-

70 marks for theory

-

3 hours exam duration

-

30 marks for project work (internal assessment)

4. What are the key units/topics in the 2025-26 syllabus?

Based on the latest CBSE curriculum for 2025-26 (exam in 2026), the syllabus includes:

-

Introduction to Book Keeping and Accounting

-

Accounting Equation Effects

-

Nature of Accounts and Rules for Debit & Credit

-

Journal

-

Ledger

-

Recording & Posting Cash Transactions

-

Trial Balance

Note: This is the broad curriculum. Some schools might also integrate practical components aligned with these units.

5. Is there any project or internal work?

Yes, project work carries 30 marks and is usually based on practical accounting tasks related to real-world recording of business transactions.

6. What types of questions are asked in the board exam?

The board paper typically includes:

-

Short answer questions

-

Long answer questions

-

Application-based questions like journal entries, ledger preparation, trial balance etc.

-

Case-based practical problems.

7. Are practice/sample question papers available for 2026?

Yes — CBSE has released sample papers (2026) with solutions that help students understand question formats and marking scheme.

8. How should I prepare for the exam?

Tips:

-

Understand concepts clearly (like rules of debit/credit, trial balance, basic bookkeeping entries).

-

Practice sample papers and previous year papers to get familiar with typical questions.

-

Keep a separate notebook for solved practical accounting exercises.

9. Is the question paper pattern fixed?

The overall pattern (marks distribution) is usually similar each year, with a mix of objective and descriptive questions aligned with the syllabus. However, exact questions vary per board session.

10. Can I use a calculator in the accountancy board paper?

As of now, there is no official CBSE notice that confirms calculator use in Class 10 Book Keeping and Accountancy for 2026 — so you should prepare assuming calculators may not be allowed (unless CBSE issues a circular). (Note: There is speculation online, but no official confirmation yet.)

11. What practical skills does this subject build?

Students learn skills like:

-

Making journal entries

-

Posting to ledger

-

Preparing trial balance

-

Handling cash book & vouchers

-

Understanding accounting formulas and effects.

12. How many units do I need to cover for board prep?

You should cover all 7 units listed in the syllabus thoroughly for the 2026 board exam.

13. Where can I find official resources for study?

Download the latest CBSE syllabus PDF and sample question papers from the official CBSE Academic website and practice accordingly.

Related Sample Paper Links: