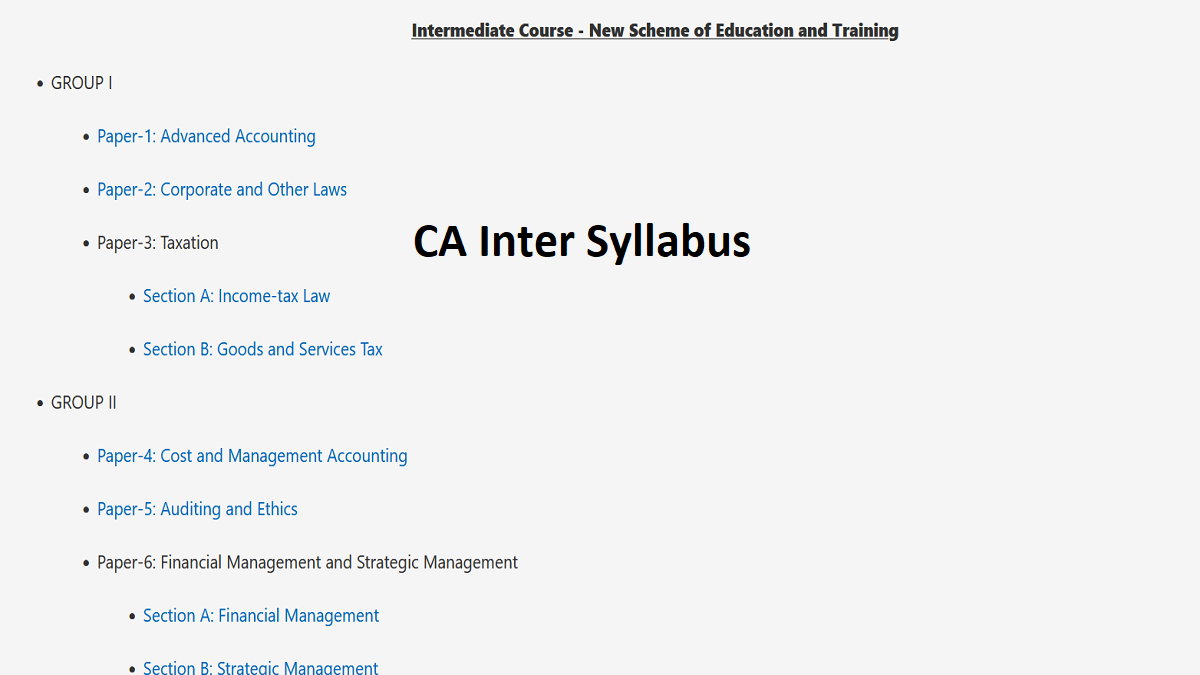

The CA Intermediate syllabus is designed to provide aspiring Chartered Accountants with comprehensive knowledge across accounting, finance, and law. Serving as the second level in the Chartered Accountancy course offered by ICAI (Institute of Chartered Accountants of India), the syllabus covers eight subjects, divided into two groups. Group 1 includes Accounting, Corporate and Other Laws, Cost and Management Accounting, and Taxation. Group 2 encompasses Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, and Financial Management & Economics for Finance. The CA Inter syllabus emphasizes practical skills, theoretical knowledge, and analytical ability, crucial for success in advanced CA levels and future professional roles.

CA Intermediate Syllabus 2025

A number of changes have been made to the ICAI’s CA Intermediate New Syllabus 2025 to better reflect modern accounting and auditing procedures. The curriculum will cover a variety of contemporary subjects and sophisticated ideas under this new plan, making it more in line with industry norms.

The material that students study will be updated to reflect current advancements in the discipline. In order to achieve a seamless transition and efficient preparation, it is imperative that candidates become acquainted with the new syllabus, which was introduced beginning with the May 2025 tests.

CA Intermediate Exam Papers

Check the CA Intermediate Syllabus 2025 subjects under the updated ICAI plan in the table below.

| CA Intermediate Exam paper 2025 |

| S. No |

Paper Name |

Marks |

| 1 |

Advanced Accounting |

100 Marks |

| 2 |

Corporate And Other Laws

Part I: Company Law And Limited Liability Partnership Law

Part Ii: Other Laws |

100 Marks

Part I: 70 Marks

Part II: 30 Marks |

| 3 |

Taxation

Section A: Income Tax Law

Section B: Goods and Services Tax |

100 Marks

Section A: 50 Marks

Section B: 50 Marks |

| 4 |

Cost and Management Accounting |

100 Marks |

| 5 |

Auditing and Ethics |

100 Marks |

| 6 |

Financial Management And Strategic Management

Section A: Financial Management

Section B: Strategic Management |

100 Marks

50 Marks

50 Marks |

CA Intermediate Syllabus 2025 Subject wise

There are six major subjects in the CA Intermediate Syllabus 2025. To gain a better grasp of the students, look at the simple breakdown of each one:

CA Inter Advanced Accounting Syllabus

This section of the CA Intermediate Syllabus 2025 focuses on producing financial statements using Indian Accounting Standards, which are comparable to IFRS, and applying accounting standards to actual business settings. Convergence or adoption of IFRS and the financial statement preparation framework are also covered.

| CA Intermediate Syllabus 2025 Advanced Accounting |

| Topics |

Sub Topics |

| Application of Accounting Standards |

- AS1 Disclosure of Accounting Policies

- AS2 Valuation of Inventories

- AS3 Cash Flow Statements

- AS4 Contingencies and Events Occurring After the Balance Sheet Date

- AS5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

- AS6 Construction Contracts

- AS8 Property, Plant and Equipment

- AS9 The Effects of Changes in Foreign Exchange Rates

- AS10 Accounting for Government Grants

- AS11 Accounting for Investments

- AS12 Accounting for Amalgamations (excluding inter-company holdings)

- AS16 Related Party Disclosures

- AS17 Leases Earnings Per Share

- AS18 Consolidated Financial Statements of single subsidiaries (excluding problems involving acquisition of Interest in Subsidiary at Different Dates, Cross holding, Disposal of a Subsidiary and Foreign Subsidiaries)

- AS19 Accounting for Taxes on Income

- AS20 Accounting for Investment in Associates in Consolidated Financial Statements

- AS21 Discontinuing Operations

- AS22 Interim Financial Reporting

- AS24 Financial Reporting of Interests in Joint Ventures

- AS25 Impairment of Assets

- AS26 Provisions, Contingent Liabilities, and Contingent Assets

|

| Company Accounts |

- Schedule III to the Companies Act, 2013 (Division I)

- Preparation of financial statements – Statement of Profit and Loss, Balance Sheet, and Cash Flow Statement

- Buyback of securities

- Accounting for the reconstruction of companies

|

| Accounting for Branches, including foreign branches. |

CA Inter Corporate and Other Laws Syllabus

Understanding legal norms and learning how to apply them in practical situations is the aim of this section of the CA Intermediate Syllabus 2025. It involves comprehending the laws and applying them in real-world situations.

- To understand the General Clauses Act’s applications and guiding principles, familiarize yourself with it.

- Learn the statutory interpretation guidelines, which are crucial for practicing law.

- Learn the fundamentals of the Foreign Exchange Management Act of 1999, including the rules pertaining to financial transactions and foreign exchange.

| CA Intermediate Syllabus 2025 Corporate and Other Laws |

| Topics |

Sub Topics |

| Part 1: COMPANY LAW AND LIMITED LIABILITY PARTNERSHIP LAW |

| The Companies Act 2013 |

Preliminary Incorporation of Company and Matters Incidental thereto, Prospectus and Allotment of Securities, Share Capital and Debentures, Acceptance of Deposits by Companies, Registration of Charges, Management and Administration, Declaration and Payment of Dividend, Accounts of Companies, Audit and Auditors, Companies Incorporated Outside India |

| The Limited Liability Partnership Act, 2008 including important Rules |

| PART 2: OTHER LAWS |

| The General Clauses Act, 1897 |

Important Definitions, Extent and Applicability, General Rules of Construction, Powers and Functionaries, Provisions as to Orders, Rules, etc. made under Enactments and

Miscellaneous provisions |

| Interpretation of Statutes |

Rules of Interpretation of Statutes, Aids to Interpretation, Rules of Interpretation/Construction of Deeds and Documents |

| The Foreign Exchange Management Act, 1999 |

Significant definitions and concepts of Current and

Capital Account Transactions |

CA Inter Taxation Syllabus

Understanding the concepts of the goods and services tax and using them to address real-world problems, as well as the laws of income tax, are the goals of the CA Intermediate Syllabus for Taxation.

| CA Intermediate Syllabus 2025 Taxation |

| Topics |

Sub Topics |

| Section A: Income Tax Laws |

| Basic Concepts |

- Income-tax law: An introduction

- Significant concepts in income-tax law, including person, assessee, previous year, assessment year, income, agricultural income

- Procedure for computation of total income and tax payable in case of individuals

|

| Residential status and scope of total income |

|

| Heads of income and the provisions governing computation of income under different heads |

- Salaries

- Income from house property

- Profits and gains of business or profession

- Capital gains

- Income from other sources

|

| Provisions relating to clubbing of income, set-off or carry forward and set-off of losses, deductions from gross total income |

| Advance Tax, Tax deduction at source and tax collection at source |

| Provisions for filing return of income and self-assessment |

| Computation of total income and income-tax payable by an individual under the alternative tax regimes under the Income-tax Act, 1961 to optimise tax liability |

| Section B: Goods And Services Tax (GST) |

Objective:

- To develop an understanding of the provisions of goods and services tax law.

- To acquire the ability to apply such provisions to address/ solve issues in moderately complex scenarios.

|

| GST Laws: An introduction including Constitutional aspects |

| Levy and collection of CGST and IGST |

- Application of CGST/IGST law

- Concept of supply including composite and mixed supplies

- Charge of tax including reverse charge

- Exemption from tax Composition levy

|

| Basic Concepts |

- Classification

- Place of supply

- Time of supply

- Value of supply

- Input tax credit

|

| Computation of GST liability |

| Registration |

| Tax invoice; Credit and Debit Notes; Electronic way bill |

| Accounts and Records |

| Returns |

| Payment of tax |

CA Inter Cost and Management Accounting Syllabus

The goals of the CA Intermediate Syllabus for Cost and Management Accounting are as follows:

1. To understand the basic ideas, use them to determine the costs of producing goods and providing services, and then utilize this data to determine prices.

2. In order to comprehend cost accounting records.

3. To use this knowledge to make decisions, plan, control, and determine expenses. To compute costs using different methodologies for different objectives.

4. Should use appropriate methods for making decisions in the short term.

| CA Intermediate Syllabus 2025 Cost and Management Accounting |

| Topics |

Sub Topics |

| Paper 4: Cost and Management Accounting |

| Overview of Cost and Management Accounting: |

Introduction to Cost and Management Accounting

- Objectives and Scope of Cost and Management Accounting.

- The users of Cost and Management accounting information, Functions of management

- Accounting.

- Role of the cost accounting department in an organization and its relation with other departments.

- Installation of Costing System.

- Relationship of Cost Accounting, Financial Accounting, Management Accounting and

- Financial Management.

- Cost Reduction and Cost Control

- Cost behavior pattern, Separating the components of fixed, variable, semi-variable, and step costs.

- Methods of Costing, Techniques of Costing.

|

Elements of Cost and Preparation of Cost Sheets

- Functional classification and ascertainment of cost.

- Preparation of Cost Sheets for the Manufacturing sector and for the Service sector.

|

| Ascertainment of Cost and Cost Accounting System |

Material Cost

- Introduction to procurement procedures. Valuation of receipts, issue and closing stock of Material, Stock verification.

- Material requirement analysis through digital costing including Government e-Marketplace (GeM). Introduction to Costing through Enterprise Resource Planning (ERP). Process of tender and quotation.

- Inventory control:

- Techniques of fixing the level of stocks- minimum, maximum, reorder point, safety stock, determination of the optimum stock level

- Determination of Optimum Order Quantity- Economic Order Quantity (EOQ)

- Techniques of Inventory control- ABC Analysis, Fast, Slow moving and Non-moving (FSN), High, Medium, Low (HML), Vital, Essential, Desirable (VED), Just-in-Time (JIT)- Stock taking and perpetual inventory system, use of inventory control ratios, Digital Inventory control.

- Treatment of Normal/Abnormal Losses w.r.t. waste, scrap, spoilage, defective, obsolescence.

|

|

Employee Cost

- Introduction to Attendance and Payroll procedures.

- Elements of wages- Basic pay, Dearness Allowance, Overtime, Bonus, Holiday and leave

- wages, Allowances, and perquisites

- Employee Turnover- Methods of calculating employee turnover, causes of employee turnover, effects of employee turnover

- Remuneration systems and incentive schemes- Premium Bonus Method (Halsey Plan and Rowan Plan

|

| Direct Expenses

Identification of direct expenses with the main product or service and its treatment |

Overheads

- Functional analysis- Factory, Administration, Selling, Distribution, Research and Development.

- Behavioral analysis- Fixed, Variable and Semi-Variable.

- Allocation and Apportionment of overheads using the Absorption Costing Method.

- Factory Overheads- Primary and secondary distribution.

- Administration Overheads- Method of allocation to cost centers or products.

- Selling & Distribution Overheads- Analysis and absorption of the expenses in products/customers, the impact of marketing strategies, and the cost-effectiveness of various methods of sales promotion.

- Treatment of Research and development cost in cost accounting

|

| Concepts of Activity-Based Costing (ABC) |

Integration of Cost and Financial Data

- Recording of financial data and its segregation.

- Introduction to Non-integrated and Integrated Accounting Systems.

- Items included in cost accounts only but financial accounts and vice versa.

- Reconciliation of profit as per Cost and Financial Accounts (under Non-Integrated Accounting System)

|

| Methods of Costing |

Single Output/ Unit Costing |

| Job Costing

Job cost cards and databases, collecting direct costs of each job, attributing overheads to jobs, Application of job costing. |

| Batch Costing

Determination of optimum batch quantity, Ascertainment of cost for a batch, Preparation of

batch cost sheet, Treatment of spoiled and defective work |

| Process/Operation Costing

Process cost recording, Process loss, Abnormal gains and losses, Equivalent units of

production, Inter-process profit, and Valuation of work in process.

Joint Products-Apportionment of joint costs, Methods of apportioning joint cost over joint Products.

By-Products-Methods of apportioning joint costs over by-products, treatment of By-Product cost |

|

Costing of Service Sectors

Determination of Costs and Prices of services |

| Cost Control and Analysis |

Standard Costing

Setting up Standards, Types of Standards, and Standard Costing as a method of performance Measurement.

Calculation and Reconciliation of Material Cost, Labour cost, Variable Overhead, Fixed Overhead. |

Marginal Costing

- Basic concepts of marginal costing, Contribution margin, Break-even analysis, Break–even and profit volume charts, Contribution to sales ratio, Margin of Safety, Angle of Incidence,

- Cost-Volume-Profit Analysis (CVP).

- Determination of Cost of a product/ service under marginal costing method, determination of

- cost of finished goods, work-in-progress.

- Comparison of Marginal costing with absorption costing method- Reconciliation of profit under both methods.

Short-term decision-making:

- Make or buy decision

- Discontinuation decision

- Multiproduct break-even analysis

- Limiting factor (key factor)

|

| Budget and Budgetary Control |

- Meaning of Budget, Essentials of Budget, Budget Manual, Budget setting process, Preparation of Budget and monitoring procedures.

- The use of budget in planning and control.

- Flexible budget, Preparation of Functional budget for operating and non-operating functions

- Cash budget, Master budget.

- Introduction to Principal/ Key budget factor Zero Based Budgeting (ZBB), Performance budget, Control ratios, and Budget variances.

- Budgets and motivation.

- Feedback and Feedforward controlling in budgeting

|

CA Inter Auditing and Ethics Syllabus

The aim of the CA Intermediate New Syllabus 2025 for auditing is to instruct you on auditing concepts, methods, and morality.

| CA Intermediate Syllabus 2025 Auditing and Ethics |

| Topics |

Sub Topics |

| Nature, Objective, and Scope of Audit |

Auditing Concepts:

- Origin of Auditing,

- Meaning of Audit,

- Need for Audit (Benefits of Audit), Objective of the Audit, Scope of Audit, External Audit engagements,

- Qualities of Auditor

- Inherent Limitations of an Audit; Relationship of auditing with other disciplines.

- (SA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Standards on Auditing)

|

| Audit Strategy, Audit Planning and Audit Program: |

- The auditor’s responsibility to plan an audit of financial statements. Benefits of audit planning.

- Planning is a continual and iterative process.

- Discussion of elements of planning with the entity’s management.

- Involvement of Key Engagement Team Members in planning the audit. Preliminary engagement activities.

- The auditor’s consideration of client continuance and ethical requirements. Planning activities.

- Establishing an overall audit strategy- Assistance for the auditor. Development of audit plan.

- Documenting the overall audit strategy and audit plan; Audit program.

- Development of Audit Plan and Program

|

| Risk Assessment and Internal Control: |

Audit Risk.

- Risk of Material Misstatement, Inherent Risk and Control Risk, and Detection Risk.

- Sampling and Non-Sampling Risk.

- Concept of Materiality, Materiality in Planning and Performing an Audit.

- The auditor’s responsibility to apply the concept of materiality.

- An auditor’s determination of materiality is a matter of professional judgment. Materiality and Audit

- Risk.

- Application of materiality in planning and performing the audit. Concept of Performance Materiality.

- Determining materiality and performance materiality when planning the audit.

- Use of Benchmarks in determining materiality for the financial statements as a whole. Materiality level or levels for particular classes of transactions, account balances, or disclosures.

- Revision in materiality as the audit progresses. Documenting the Materiality.

(SA 320 Materiality in Planning and Performing an Audit).

- Identifying and Assessing the Risk of Material Misstatement, Risk Assessment procedures.

- Understanding the entity and its environment; Internal control.

- Documenting the Risks.

- Evaluation of internal control system.

- Testing of Internal control; Internal Control and IT Environment (SA 315 Identifying and Assessing the

- Risks of Material Misstatement Through Understanding the Entity and Its Environment).

Digital Audit

- Key features

- Impact of IT-related Risks

- Impact on Controls

- Internal Financial Controls as per Regulatory requirements

- Types of Controls

- Audit approach

- Understanding and documenting Automated environment

- Testing methods, data analytics for audit, assessing and reporting audit findings.

|

| Audit Evidence |

- Meaning of Audit Evidence.

- Relevance and Reliability of Audit Evidence

- Sufficient appropriate audit evidence

- Meaning of Assertions

- Assertions contained in the Financial Statements. Source of audit evidence

- Test of controls

- Substantive Procedures- Test of details and Substantive analytical procedures, Audit procedures for obtaining audit evidence.

- Evaluation of Audit Evidence (SA 500 Audit Evidence), Audit Trail

(Using the work of Internal Auditors – SA 610)

- Internal audit function.

- External Auditor’s Responsibility for the audit, Evaluating the internal audit function.

- Basics of Internal Financial Control and reporting requirements. The distinction between Internal Financial Control and Internal Control over Financial Reporting.

- Audit Sampling: (SA 530 Audit Sampling). Meaning of Audit Sampling.

- Designing an audit sample; Types of sampling (Approaches to Sampling).

- Sample Size and selection of items for testing; Sample selection method.

- Obtaining evidence of the existence of inventory; Audit procedure to identify litigation & claims.

- Obtaining evidence regarding the presentation and disclosure of segment information

- (SA 501 Audit Evidence – Specific Considerations for Selected Items)

- External confirmation procedures.

- Management’s refusal to allow the auditor to send a confirmation request; Negative Confirmations (SA 505 External Confirmations); Audit evidence about opening balances; Accounting policies relating to opening balances; Reporting with regard to opening balances (SA 510 Initial Audit Engagements-Opening Balances)

- Meaning of Related Party; Nature of Related Party Relationships & Transactions; Understanding the Entity’s Related Party Relationships & Transactions (SA 550 Related Parties)

- Analytical Procedures.

- Meaning, nature, purpose, and timing of analytical procedures; Substantive analytical procedures.

- Designing and performing analytical procedures prior to Audit.

- Investigating the results of analytical procedures (SA 520 Analytical Procedures)

|

| Audit of Items of Financial Statements |

- Audit of sale of Products and Services; Audit of Interest Income, Rental Income, Dividend Income, Net gain/loss on sale of Investments, etc.

- Audit of Purchases, Employee benefits expenses, Depreciation, Interest expense, Expenditure on Power and fuel, Rent, Repair to building, Repair to Machinery, Insurance, Taxes, Travelling Expenses, Miscellaneous Expenses, etc.

- Audit of Share Capital, Reserve and surplus, Long-term Term Borrowings, Trade Payables, Provisions, Short-term Term Borrowings, and other Current Liabilities.

- Audit of Land, Buildings, Plant and equipment, Furniture and fixtures, Vehicles, office equipment, Goodwill, Brand/Trademarks, Computer Software, etc.

- Audit of Loans and advances, Trade Receivable, Inventories, Cash and cash Equivalent, and Other Current Assets. Audit of Contingent Liabilities. (The list of items is illustrative only.)

|

| Audit Documentation |

- Concept of Audit Documentation

- Nature & Purpose of Audit Documentation; Form, Content & Extent of Audit Documentation. Completion Memorandum.

- Ownership and custody of Audit Documentation (SA 230 Audit Documentation).

|

| Completion and Review |

- Meaning of Subsequent Events;

- Auditors’ obligations in different situations of subsequent events.

- Procedures for subsequent events. (SA 560 Subsequent Events).

- Responsibilities of the Auditor with regard to Going Concern Assumption; Objectives of the Auditor

- regarding Going Concern.

- Events or Conditions that may cast doubt about the Going Concern Assumption.

- Audit Procedures when events or conditions are identified (SA 570 Going Concern). Overview and

- Introduction of Evaluations of Misstatements identified during the audit (SA 450).

- Written Representations as Audit Evidence.

- Objective of Auditor regarding Written Representation.

- Management from whom Written Representations may be requested.

|

| Audit Report |

- Forming an opinion on the Financial Statements.

- Auditor’s Report- basic elements (SA 700 Forming an Opinion and Reporting on Financial Statements).

- Communicating key Audit Matters in the Independent Auditor’s Report (SA 701) Types of Modified Opinion, Circumstances When a Modification to the Auditor’s Opinion is Required, Qualified, Adverse Disclaimer of Opinion (SA 705 Modification to the Opinion in the Independent Auditor’s Report).

- SA 706 Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report.

- Nature of Comparative Information.

- Corresponding Figure; Comparative Financial Statements (SA 710 Comparative Information – Corresponding Figures and Comparative Financial Statements).

- Branch audit; Joint audit; Reporting requirements under the Companies Act, 2013, including CARO

|

| Special Features of Audit of Different Types of Entities |

- Appointment of Auditor,

- Audit Procedure and Audit Report in respect of different Category of Entities

- Government; Local bodies; Not-for-profit organizations; Trust and Societies, Partnership Firms

- Audit of different types of undertakings, i.e., Educational Institutions, Hotels, Clubs, Hospitals, etc.

- Basics of Limited Liability Partnerships (LLPs) Audit and Co-operative Societies Audit.

|

| Audit of Banks |

- Understanding of accounting systems in Banks

- Audit Approach

- Audit of Revenue items,

- Special Consideration in Bank Audit with emphasis on Advances and NPAs

|

| Ethics and Terms of Audit Engagements |

- Meaning of Ethics. – Ethics is a State of Mind, Need for Professional Ethics.

- Principles-based approach v Rules-based approach (Ethical or Legal).

- The fundamental principles of Professional Ethics: Integrity;

- Objectivity; Professional Competence and Due care; Confidentiality; Professional Behaviour.

- Independence of Auditors.

- Threats to Independence: Self-interest threats, Self Review threats, Advocacy threats, Familiarity threats, Intimidation threats.

- Safeguards to Independence; Professional Scepticism, Terms of Audit Engagements Preconditions for an audit; Audit Engagement

- Agreement on Audit Engagement Terms

- Terms of Engagement in Recurring Audits (SA 210 Agreeing the Terms of Audit Engagements)

- Overview and Introduction of SQC 1 Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information and Other Assurance and Related Services Engagements

- Overview and Introduction of SA 220 – Quality Control for an Audit of Financial Statements).

|

CA Inter Financial Management and Strategic Management Syllabus

You may learn how to handle working capital, make wise financial decisions, and comprehend money management with the CA Intermediate Syllabus 2025 in Financial Management.

| CA Intermediate Syllabus 2025 Financial Management and Strategic Management |

| Topics |

Sub Topics |

| SECTION A: FINANCIAL MANAGEMENT |

| Financial Management and Financial Analysis |

Introduction to Financial Management Function

- Introduction to Financial Management Function

- Objective and scope of financial management

- Profit Maximisation, Wealth Maximisation and Value Creation

- Role of Financial Manager and Financial Controller

- Financial management environment

- Functions of finance executives in an organization

- Financial distress and insolvency

|

Financial Analysis through Ratios

- Users of financial analysis.

- Sources of financial data for analysis.

- Calculation and Interpretation of ratios.

- Limitations of ratio analysis

|

| Financing Decisions and Cost of Capital |

Sources of Finance

- Different Sources of Finance, Characteristics of different types of long-term debt and equity

- finance, Method of raising long-term finance.

- Different Sources of Short-term Finance.

- Contemporary sources of funding- P2P lending, Equity funding, Crowdfunding, Start-up funding, etc.

- Internal funds as a source of finance.

- International sources of finance

- Other sources of finance- Lease Financing, Sale and leaseback, Convertible debt, Venture capital, Grants, etc.

|

Cost of Capital

- Significance of cost of capital

- Factors of cost of capital

- Measurement of costs of individual components of capital

- Weighted average cost of capital (WACC)

- The marginal cost of capital.

|

Capital Structure Decisions

- Significance of capital structure

- Determinants of capital structure

- Capital structure planning and designing

- Designing of optimum capital structure.

- Theories of Capital Structure and Value of the firm-relevancy and Irrelevancy of Capital Structure

- EBIT- EPS Analysis, Breakeven- EBIT Analysis.

- Under/ Over Capitalisation

|

Leverages

- Types of Leverages- Operating,

- Financial and Combined. Analysis of leverages.

|

| Capital Investment and Dividend Decisions: |

Capital Investment Decisions:

The objective of capital investment decisions

Methods of Investment Appraisal

Payback period, Discounted payback period.

Accounting Rate of Return (ARR).

Net Present Value (NPV) – The meaning of NPV, Strengths, and limitations of NPV method, The working capital adjustment in NPV analysis, Capital rationing, and Equivalent Annual Costs.

Internal Rate of Return (IRR)- Limitations of the IRR method, Multiple IRRs.

Modified Internal Rate of Return (MIRR)- Definition and explanation of MIRR, Process for calculating MIRR, Strengths of the MIRR approach. – Profitability Index |

Dividend Decisions

- Cash dividend, stock dividend/ bonus share, stock splits, share buyback.

- Determinants of dividend.

- Relevancy and Irrelevancy of Dividend Policies- Traditional Approach, Walter’s model, Gordon’s model, Modigliani and Miller (MM) Hypothesis

|

| Management of Working Capital: |

- The management of working capital- Liquidity and Profitability.

- The Working capital financing decisions- Primary and Secondary Sources of Liquidity.

- The Working Capital Cycle (Operating Cycle) is the effectiveness of Working Capital based on its operating and cash conversion cycles.

- Assessment of working capital requirement.

- Management of Accounts Receivables (Debtors).

- Factoring and Forfaiting.

– Credit granting.

– Monitoring accounts receivables.

– Debt collection.

- Management of Accounts Payables (Creditors). Management of Cash and treasury management.

- Banking norms of working capital finance

|

| SECTION B: STRATEGIC MANAGEMENT (50 MARKS) |

| Introduction to Strategic Management |

- Meaning and Nature of Strategic Management.

- Importance and Limitations of Strategic Management.

- Strategic Intent – Vision, Mission, Goals and Values.

- Strategic Levels in Organizations (Network, Corporate, Business and Functional)

|

| Strategic Analysis: External Environment |

- International and Macro Environment: PESTLE

- Analysis. Defining the industry for analysis (Value Chain, PLC).

- Porter’s Five Forces – Industry environment analysis.

- Understanding customers and markets.

- Competition in the industry

|

| Strategic Analysis: Internal Environment |

- Understanding key stakeholders (Mendelow’s Model).

- Strategic drivers (Industry & markets, Customers, Channels, Products & Services, Competitive

- Advantage).

- The role of resources and capabilities.

- Combining external and internal analysis (SWOT Analysis).

- Gaining competitive advantage (Michael Porter’s Generic Strategies).

|

| Strategic Choices |

- Strategic Choices: Concentric, Conglomerate, Market Development, Product Development, Innovation, Horizontal integration, vertical integration, Turnaround, Divesture, Liquidation.

- How to Develop Strategic Options:

- Ansoff’s Matrix

- ADL Matrix

- BCG Matrix

- GE Matrix

|

| Strategy Implementation and Evaluation |

- Implementation: Formulation vs. Implementation Matrix, Linkages and Issues.

- Strategic Change through Digital Transformation.

- Organization Structure (hard) and Culture (soft).

- Strategic Leadership.

- Strategic Control.

- Strategic Performance Measures

|

CA Intermediate Preparation Tips

Preparing for the CA Intermediate exam requires a strategic approach, as it’s the second level of the Chartered Accountancy course and includes eight subjects across two groups. Here are some focused tips to help maximize your preparation:

Understand the Exam Structure

- CA Intermediate is divided into two groups with four papers each.

- Group I covers Accounting, Corporate and Other Laws, Cost and Management Accounting, and Taxation.

- Group II includes Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, and Financial Management & Economics for Finance.

Plan a Realistic Study Schedule

- Dedicate specific hours each day for focused study. Aim for 10-12 hours daily if you’re studying full-time.

- Divide your time to cover both groups effectively, or concentrate on one group if that’s your plan.

Set Weekly and Monthly Goals

- Break down the syllabus and set clear, achievable goals for each week and month.

- Allocate more time to challenging topics and revise them periodically.

Focus on Conceptual Clarity

- CA exams emphasize conceptual understanding over rote learning.

- For subjects like Accounting and Financial Management, ensure that you fully understand the principles and frameworks.

Master Practical Subjects with Practice

- Subjects like Accounting, Taxation, and Financial Management require extensive practice.

- Practice from ICAI study material, RTPs (Revision Test Papers), and previous exam papers.

Use Mnemonics for Theory Subjects

- For theory-intensive subjects like Law and Auditing, mnemonics can help you retain sections and clauses.

- Summarize and frequently review key points, amendments, and provisions.

Stay Updated with Amendments

- Laws and Taxation are subjects where amendments are crucial. Regularly check for updates from the ICAI website.

- Include recent case laws and changes in tax rates in your notes.

Revise Regularly

- Make time for multiple revisions to reinforce concepts and improve retention.

- A well-spaced revision schedule helps you avoid last-minute cramming and strengthens recall during the exam.

Mock Tests and Time Management

- Attempt ICAI-provided mock tests under exam-like conditions.

- Focus on time management; aim to complete each paper in the allocated three hours during practice sessions.

Stay Calm and Confident

- Avoid burnout by taking short breaks, staying active, and getting enough rest.

- Stay confident in your preparation, and remember that CA exams require patience, persistence, and a positive mindset.

FAQs

Q. 1 What subjects are covered in the CA Intermediate syllabus?

Ans. The CA Intermediate syllabus consists of two groups, each containing four subjects. Group I includes Accounting, Corporate and Other Laws, Cost and Management Accounting, and Taxation. Group II includes Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, and Financial Management & Economics for Finance.

Q. 2 What is the duration of the CA Intermediate course?

Ans. The CA Intermediate course duration typically ranges from 8 to 10 months, depending on the student’s preparation and study schedule. It includes regular classes, self-study, and revision time.

Q. 3 What are the passing criteria for CA Intermediate?

Ans. To pass each group in CA Intermediate, a candidate needs a minimum of 40% marks in each subject and an aggregate of 50% across all subjects in the group. Both groups can be cleared together or individually.

Q. 4 How can I prepare for the CA Intermediate exams?

Ans. Effective preparation for CA Intermediate exams involves a detailed study of ICAI’s provided syllabus, study materials, and regular practice of mock tests and revision exams. Planning a study timetable, understanding each subject’s concepts, and revising frequently are crucial.

Q. 5 Can I skip any subject in CA Intermediate?

No, CA Intermediate does not allow skipping any subject. Students must attempt all subjects within a group, as each is mandatory and contributes to the overall score required to pass the group.

Related Articles:

TNPSC Group 4 Syllabus

RRB NTPC Syllabus

REET Syllabus

Odisha Police SI Syllabus

About The Author

Brajesh (MCA, M.Tech (IT)) is a passionate education and career content creator with a strong academic background in Computer Applications (MCA) and Technology (M.Tech). With years of hands-on experience in exam preparation strategies, syllabus analysis, and government job updates, he helps students and aspirants navigate their academic and professional journeys with clarity and confidence.