The JKSSB Finance Accounts Assistant Syllabus 2025–26 plays a crucial role for aspirants preparing for one of Jammu and Kashmir’s most sought-after finance sector recruitment exams. Conducted by the Jammu and Kashmir Services Selection Board (JKSSB), this exam aims to select skilled candidates for maintaining financial records, accounts management, auditing support, and other essential administrative functions within various government departments. To succeed in the upcoming recruitment cycle, candidates must gain a clear understanding of the updated syllabus, exam pattern, marking scheme, and subject-wise weightage.

The syllabus for 2025–26 has been designed to test a candidate’s proficiency in Mathematics, General Knowledge, Accountancy & Bookkeeping, Economics, General English, Statistics, and Computer Applications. It emphasizes conceptual clarity, analytical aptitude, and practical understanding of financial operations. A thorough study of each section not only helps candidates score better but also builds a strong foundation for their future roles in government finance offices.

In this article, you will find detailed insights into the latest JKSSB Finance Accounts Assistant syllabus, including topic-wise breakdown, key focus areas, preparation tips, and recommended study resources to help you streamline your exam strategy effectively.

JKSSB Finance Accounts Assistant Syllabus 2025-26

The JKSSB Finance Accounts Assistant Syllabus 2025-26 and exam pattern for JKSSB Finance/Accounts Assistant (often called Finance Account Assistant / Accounts Assistant) for 2025–26. Use this as a checklist while preparing.

Selection Process & Exam Pattern — Key Highlights (2025-26)

-

The recruitment for Accounts Assistant (Finance Department) under JKSSB is through a single written/OMR-based exam, followed by document verification. No interview is usually involved.

-

The exam will be objective-type multiple choice questions (MCQs) only.

-

Language: Paper is set in English only.

-

Negative marking: Yes — 0.25 marks will be deducted for each wrong answer.

-

Duration: Typically 2 hours (120 minutes).

-

Total marks: Commonly 120 marks across several sections — although some recent notifications/articles mention a 125-mark scheme (or sometimes 180 marks in older/emerging drafts) depending on the pattern.

-

The final selection is on the basis of merit in written exam + document verification.

Important (2025 Update): The latest 2025-26 vacancy notification for 600 posts confirms that selection will be by written exam (OMR) + document verification.

JK Finance Accounts Assistant Syllabus 2025-26 Subject-wise

Based on recent and past exam syllabi for JKSSB Accounts / Finance Assistant posts, the written paper typically includes the following sections/topics.

| Section / Subject | Key Topics / Focus Area |

|---|---|

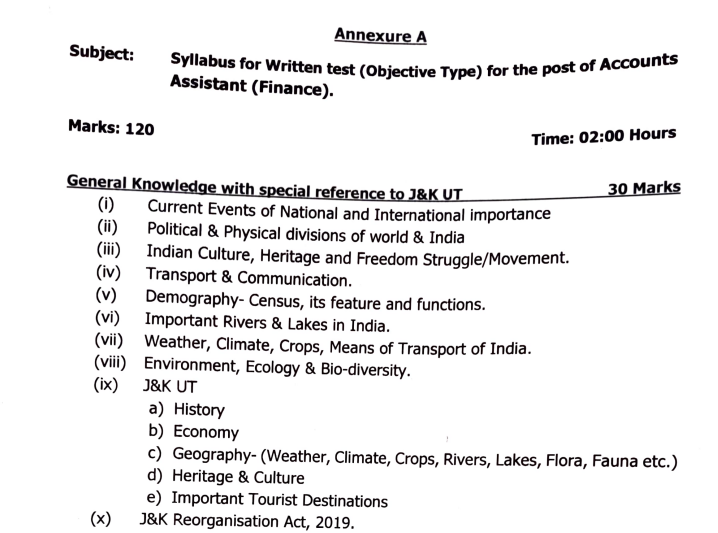

| General Knowledge (with special focus on Jammu & Kashmir UT) | Current events (national + international), Indian & world geography, history (Indian + J&K), culture, heritage, freedom struggle, demographics/population, climate & crops, rivers/lakes, transport & communication, economy of India & J&K, environment & biodiversity, constitution/politics/governance basics (especially relevant acts/history of J&K), science & technology developments. |

| Accountancy and Book-Keeping / Finance & Accounts | Financial accounting fundamentals: double-entry bookkeeping, ledger & journal entries, vouchers, bank reconciliation, cash book, trial balance, trading account, profit & loss account, balance sheet; partnership accounts; bank reconciliation; financial statements; basics of auditing; cost accounting; budgetary control; public financial management (PFMS), Indian financial management systems; basics of taxation (direct & indirect tax, GST), developments in accounting. |

| Mathematics / Statistics / Quantitative Aptitude & Reasoning | Basic arithmetic, percentages, ratios, profit & loss, simple interest/compound interest, time & work, time & distance, data interpretation (tables, graphs), basic statistics concepts (mean, median, mode, probability), reasoning questions (logical ability / mental ability). |

| General Economics | Basic macro- and micro-economics concepts, public finance basics, fiscal policy, economic indicators, understanding of economy (national and regional) as related to J&K / India. |

| Computer/IT Knowledge (Basic Computer Applications) | Fundamentals of computers, MS Office, basics of data management, office software, digital finance tools, internet basics, file management — general computer literacy as applicable to office/administrative tasks. |

| General Science | Basic science — physics, chemistry, biology: e.g. laws of motion, energy, electricity; environmental science; general science knowledge. |

| General English | English grammar and language skills: tenses, sentence rearrangement, narration, modals, articles, grammar (clauses, parts of speech), comprehension, vocabulary (synonyms/antonyms), idioms/phrases, active/passive voice, prepositions, reading comprehension. |

Note: The exact weightage for some sections (e.g. Computer, English, Science, Reasoning) may vary depending on the exam’s specific pattern or recent notification — so treat this as the standard/well-known model from previous cycles.

What’s New / What to Watch Out in 2025–26 Cycle

-

The 2025–26 recruitment notification (Advt. No. 10 of 2025) for 600 posts in Finance Department confirms the selection via written exam + document verification only.

-

Though earlier pattern used 120 marks, some recent sources mention 125 marks or other variations (for example: GK 25 + Accounts 50 + English 25 + Quant/Reasoning 25 = 125).

-

The core syllabus, especially accounting & bookkeeping, mathematics/statistics, GK (with J&K focus), and basic computer knowledge, remains the same. Many aspirants recommend starting from basics (especially if from non-commerce background) — and that remains valid.

-

Because there is negative marking, accuracy matters more than attempts — blind guesswork can reduce your score.

Preparation Strategy — What You Should Do

Given the syllabus & pattern described above, here is a suggested prep plan:

-

Start with Accounting & Bookkeeping basics — clear fundamentals of ledger, journal, balance sheet, bookkeeping rules, double-entry, etc.

-

Brush up quantitative aptitude & reasoning — focus on arithmetic, statistics basics, data interpretation, speed and accuracy.

-

Regularly update General Knowledge (India + J&K) — current affairs (last 6-12 months), history, geography, polity, important schemes, J&K-specific facts.

-

Build computer literacy — MS Office, basic accounting/computer applications — as it’s useful for office work.

-

Improve English language skills — grammar, comprehension, vocabulary — to handle English-only paper.

-

Don’t ignore basic science and economics — even if lighter weight, they add marks.

-

Practice mock tests / past year papers under exam-like conditions (timed MCQ + negative marking) to improve speed & accuracy.

JKSSB Finance Accounts Assistant Syllabus 2025 PDF

Download Free PDF by clicking on the link below:

FAQs

Q: What is the post and how many vacancies are there?

A: The current recruitment is for the post of Accounts Assistant (Finance Department, J&K UT). 600 vacancies have been announced under Advertisement No. 10 of 2025.

Q: What are the eligibility criteria (education, domicile, age)?

A:

-

Educational: Graduation in any discipline from a recognized university. For general (open merit) — minimum 50% marks; for reserved categories — 45%. Post-graduates (with 50%) or Ph.D. degree holders are also eligible.

-

Domicile: Must have a valid domicile certificate of Jammu & Kashmir (as per rules).

-

Age: Lower age limit is 18 years. Upper age (as on 01-01-2025): 40 years for Open Merit; relaxation up to 43 years for reserved categories. Other relaxations apply as per category (e.g. PwBD, Ex-servicemen) per notification.

Q: What is the selection process? Is there an interview?

A: Selection is purely based on a written objective-type (OMR / MCQ) examination followed by document verification. There is no interview stage, as per official 2025 notification.

Q: What is the exam pattern (marks, time, negative marking)?

A: According to the 2025 notification:

-

The exam is MCQ-based (objective) in English.

-

Negative marking: 0.25 marks will be deducted for each wrong answer.

-

Duration: 2 hours.

-

Distribution of subjects (approximate from past syllabus; official detailed syllabus upload is awaited) includes: General Knowledge (especially J&K), Accounting & Book-keeping, General English, Mathematics/Statistics, Economics, Computer knowledge, and possibly General Science.

Q: What are the detailed syllabus topics I should prepare for?

A: Based on the earlier (revised) syllabus for FAA, these are the major areas:

-

General Knowledge (with special reference to J&K UT):

-

Current events (national & international)

-

Geography & political/physical divisions of India/world

-

Climate, crops, transport & communication

-

Indian culture, heritage, history (esp. freedom movement)

-

Indian economy, environment, biodiversity, science & technology

-

History, economy, geography, culture of J&K; relevant acts (e.g. J&K Reorganisation Act, 2019)

-

-

Accountancy & Book-Keeping:

-

Basic financial accounting: accounting terms, accounting equation, journal, ledger, voucher approach, cash book

-

Bank reconciliation, double-entry bookkeeping, trial balance

-

Trading account, profit & loss account, balance sheet

-

Partnership accounts, financial statements, audits

-

Cost accounting, budgetary control, taxation (direct/indirect), public financial management (PFMS), broader Indian financial/accounting system fundamentals

-

-

Mathematics & Statistics: basic arithmetic, algebra, linear equations, percentages, averages; statistics topics like data collection, central tendency, probability, index numbers, demography & vital statistics.

-

General Economics: basic micro & macro-economic concepts, demand analysis, supply, production factors, market forms, fiscal & monetary policy, government finance.

-

General English: grammar (tenses, modals, articles), sentence rearrangement, narration (voice), comprehension, vocabulary (synonyms/antonyms), idioms/phrases, prepositions, clauses.

-

General Science: (in older syllabus) basics of science — environment, ecology, biology, physics/chemistry basics.

-

Computer Knowledge: MS Office (Word, Excel, PowerPoint), Internet, e-mail, basic hardware/software concepts, accounting software basics, computer fundamentals.

-

Q: Has the official detailed syllabus for 2025 exam been released yet?

A: As of now (Dec 2025), the detailed syllabus PDF has not been publicly released with the 2025 advertisement. The board refers to the known “Accounts/Finance syllabus” used in past years. -

Q: From which date to when can I apply?

A: Online application opens on 8 December 2025, and the last date to apply is 6 January 2026 for the 2025 recruitment cycle. -

Q: Will wrong answers lead to negative marking?

A: Yes — 0.25 marks will be deducted for each wrong answer. -

Q: Is there any interview after written exam?

A: No. Selection is purely based on the written (objective) test and document verification. -

Q: Are fresh graduates (non-commerce) eligible?

A: Yes. Any graduate (any stream) fulfilling the eligibility criteria is eligible — commerce background is not mandatory. -

Q: Should I start preparing even though detailed syllabus isn’t out yet?

A: Yes. Based on past syllabus and board’s reference to same syllabus, fundamental topics like GK (India + J&K), Accountancy basics, Maths/Statistics, English, Computers, Economics etc. are almost certain to remain. Starting early gives advantage. Many aspirants in forum discussion are already beginning prep.